| |

|

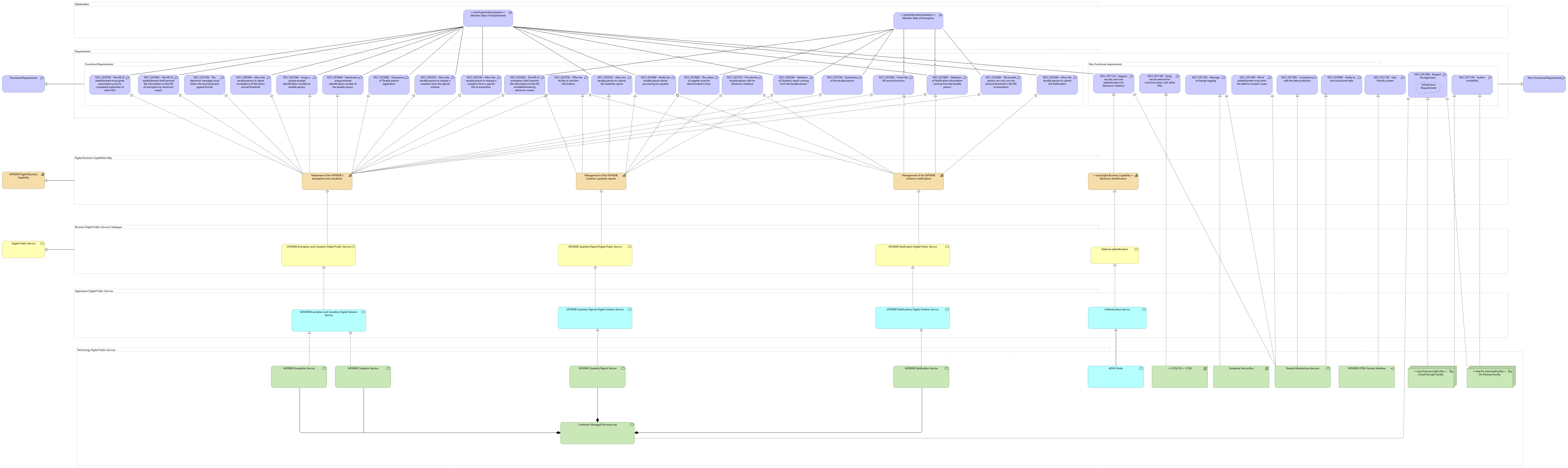

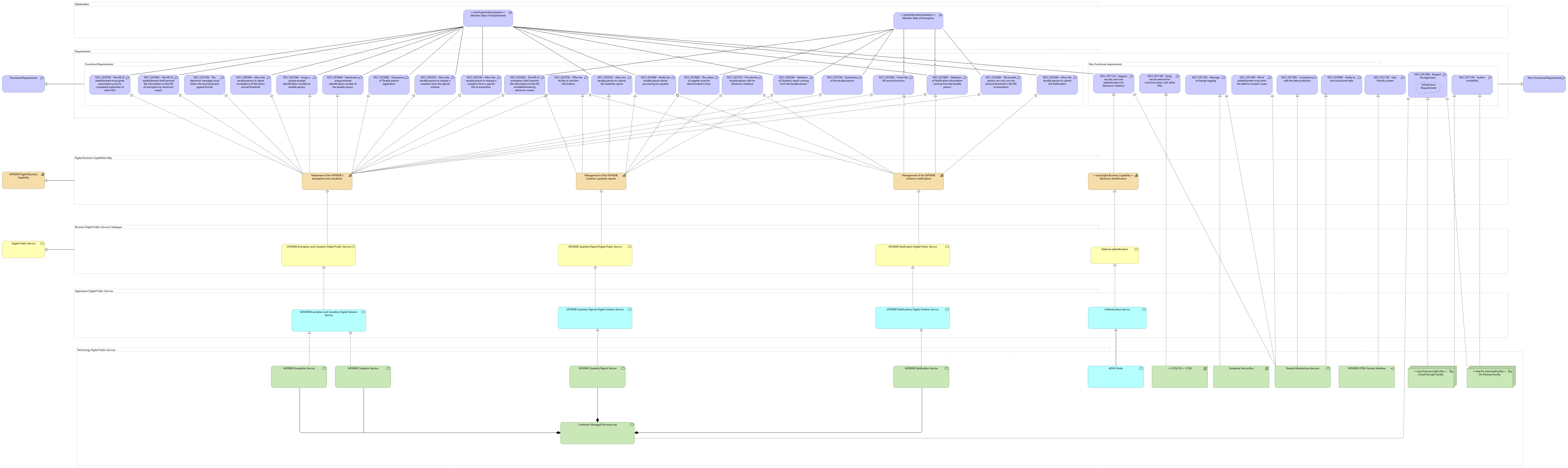

Requirements |

Functional Requirements |

| |

|

Requirements |

Non-functional requirements |

| |

|

Functional Requirements |

Functional Requirement |

| |

|

Functional Requirements |

MCC.2910520 - Allow the taxable person to request a cessation from the special scheme |

| |

|

Functional Requirements |

MCC.2910560 - Assign a unique exempt identification number to taxable person |

| |

|

Functional Requirements |

MCC.2910580 - Check the MS annual turnover |

| |

|

Functional Requirements |

MCC.2910640 - Deactivate a unique exempt identification number of the taxable person |

| |

|

Functional Requirements |

MCC.2910680 - Notify the taxable person about processing his requests |

| |

|

Functional Requirements |

MCC.2910700 - Offer the facility to save the information |

| |

|

Functional Requirements |

MCC.2910720 - Provide the taxable person with an Electronic interface |

| |

|

Functional Requirements |

MCC.2910740 - Quarantine of the taxable person |

| |

|

Functional Requirements |

MCC.2910760 - The electronic messages must follow the structured and agreed format |

| |

|

Functional Requirements |

MCC.2910780 - The MS of establishment must grant automated access to competent authorities of other MSs |

| |

|

Functional Requirements |

MCC.2910800 - The MS of establishment shall transmit the information to the MS of exemption by electronic means |

| |

|

Functional Requirements |

MCC.2910820 - The MS of exemption shall transmit the information to the MS of establishment by electronic means |

| |

|

Functional Requirements |

MCC.2910840 - The taxable person can only use one sectoral threshold in the MS of exemption |

| |

|

Functional Requirements |

MCC.2910860 - The values of supplies must be denominated in Euro |

| |

|

Functional Requirements |

MCC.2910880 - Uniqueness of Taxable person registration |

| |

|

Functional Requirements |

MCC.2910900 - Validation of Notification information coming from the taxable person |

| |

|

Functional Requirements |

MCC.2954380 - Validation of Quarterly report coming from the taxable person |

| |

|

Functional Requirements |

MCC.2955240 - Allow the taxable person to request a cessation from a specific MS of exemption |

| |

|

Functional Requirements |

MCC.2955300 - Allow the taxable person to submit the Notification |

| |

|

Functional Requirements |

MCC.2955320 - Allow the taxable person to submit the Quarterly report |

| |

|

Functional Requirements |

MCC.2955400 - Allow the taxable person to report exceedance of the Union annual threshold |

| |

|

Non-functional requirements |

MCC.2911080 - Respect the legal base |

| |

|

Non-functional requirements |

MCC.2911020 - Message exchange logging |

| |

|

Non-functional requirements |

MCC.2911180 - Using secure network for communication with other MSs |

| |

|

Non-functional requirements |

MCC.2911040 - MS of establishment must store the data for at least 5 years |

| |

|

Non-functional requirements |

MCC.2911000 - Compliance with the data protection |

| |

|

Non-functional requirements |

MCC.2911140 - System availability |

| |

|

Non-functional requirements |

MCC.2910980 - Ability to store structured data |

| |

|

Non-functional requirements |

MCC.2911120 - Support security and user authentication for Electronic interface |

| |

|

Non-functional requirements |

MCC.2911160 - User friendly system |

| |

|

Non-functional requirements |

Non-Functional Requirement |

| |

|

Stakeholders |

<<eira:PublicAdministration>> Member State of Establishment |

| |

|

Stakeholders |

<<eira:PublicAdministration>> Member State of Exemption |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2910520 - Allow the taxable person to request a cessation from the special scheme |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2910560 - Assign a unique exempt identification number to taxable person |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2910640 - Deactivate a unique exempt identification number of the taxable person |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2910680 - Notify the taxable person about processing his requests |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2910780 - The MS of establishment must grant automated access to competent authorities of other MSs |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2910800 - The MS of establishment shall transmit the information to the MS of exemption by electronic means |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2910880 - Uniqueness of Taxable person registration |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2910900 - Validation of Notification information coming from the taxable person |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2954380 - Validation of Quarterly report coming from the taxable person |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2955240 - Allow the taxable person to request a cessation from a specific MS of exemption |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2955300 - Allow the taxable person to submit the Notification |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2955320 - Allow the taxable person to submit the Quarterly report |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2955400 - Allow the taxable person to report exceedance of the Union annual threshold |

| |

|

<<eira:PublicAdministration>> Member State of Establishment |

MCC.2911120 - Support security and user authentication for Electronic interface |

| |

|

<<eira:PublicAdministration>> Member State of Exemption |

MCC.2910580 - Check the MS annual turnover |

| |

|

<<eira:PublicAdministration>> Member State of Exemption |

MCC.2910740 - Quarantine of the taxable person |

| |

|

<<eira:PublicAdministration>> Member State of Exemption |

MCC.2910820 - The MS of exemption shall transmit the information to the MS of establishment by electronic means |

| |

|

<<eira:PublicAdministration>> Member State of Exemption |

MCC.2910840 - The taxable person can only use one sectoral threshold in the MS of exemption |

| |

|

<<eira:PublicAdministration>> Member State of Exemption |

MCC.2910860 - The values of supplies must be denominated in Euro |

| |

|

<<eira:PublicAdministration>> Member State of Exemption |

MCC.2910900 - Validation of Notification information coming from the taxable person |

| |

|

<<eira:PublicAdministration>> Member State of Exemption |

MCC.2954380 - Validation of Quarterly report coming from the taxable person |

| |

|

Digital Business Capabilities Map |

VAT4SME Digital Business Capability |

| |

|

Digital Business Capabilities Map |

<<eira:Digital Business Capability>> Electronic identification |

| |

|

Digital Business Capabilities Map |

Management of the VAT4SME schema's notifications |

| |

|

Digital Business Capabilities Map |

Management of the VAT4SME schema's quarterly reports |

| |

|

Digital Business Capabilities Map |

Treatament of the VAT4SME`s exemptions and cessations |

| |

|

<<eira:Digital Business Capability>> Electronic identification |

MCC.2911120 - Support security and user authentication for Electronic interface |

| |

|

Management of the VAT4SME schema's notifications |

MCC.2910580 - Check the MS annual turnover |

| |

|

Management of the VAT4SME schema's notifications |

MCC.2910900 - Validation of Notification information coming from the taxable person |

| |

|

Management of the VAT4SME schema's notifications |

MCC.2910680 - Notify the taxable person about processing his requests |

| |

|

Management of the VAT4SME schema's notifications |

MCC.2910700 - Offer the facility to save the information |

| |

|

Management of the VAT4SME schema's notifications |

MCC.2910720 - Provide the taxable person with an Electronic interface |

| |

|

Management of the VAT4SME schema's notifications |

MCC.2955300 - Allow the taxable person to submit the Notification |

| |

|

Management of the VAT4SME schema's quarterly reports |

MCC.2954380 - Validation of Quarterly report coming from the taxable person |

| |

|

Management of the VAT4SME schema's quarterly reports |

MCC.2910860 - The values of supplies must be denominated in Euro |

| |

|

Management of the VAT4SME schema's quarterly reports |

MCC.2910680 - Notify the taxable person about processing his requests |

| |

|

Management of the VAT4SME schema's quarterly reports |

MCC.2910820 - The MS of exemption shall transmit the information to the MS of establishment by electronic means |

| |

|

Management of the VAT4SME schema's quarterly reports |

MCC.2955320 - Allow the taxable person to submit the Quarterly report |

| |

|

Management of the VAT4SME schema's quarterly reports |

MCC.2910700 - Offer the facility to save the information |

| |

|

Management of the VAT4SME schema's quarterly reports |

MCC.2910720 - Provide the taxable person with an Electronic interface |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910840 - The taxable person can only use one sectoral threshold in the MS of exemption |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910900 - Validation of Notification information coming from the taxable person |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910580 - Check the MS annual turnover |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910740 - Quarantine of the taxable person |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910800 - The MS of establishment shall transmit the information to the MS of exemption by electronic means |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910820 - The MS of exemption shall transmit the information to the MS of establishment by electronic means |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910760 - The electronic messages must follow the structured and agreed format |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910780 - The MS of establishment must grant automated access to competent authorities of other MSs |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910560 - Assign a unique exempt identification number to taxable person |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910640 - Deactivate a unique exempt identification number of the taxable person |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910880 - Uniqueness of Taxable person registration |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910520 - Allow the taxable person to request a cessation from the special scheme |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2955240 - Allow the taxable person to request a cessation from a specific MS of exemption |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2910700 - Offer the facility to save the information |

| |

|

Treatament of the VAT4SME`s exemptions and cessations |

MCC.2955400 - Allow the taxable person to report exceedance of the Union annual threshold |

| |

|

Business Digital Public Services Catalogue |

Digital Public Service |

| |

|

Business Digital Public Services Catalogue |

VAT4SME Exemption and Cessation Digital Public Service |

| |

|

Business Digital Public Services Catalogue |

VAT4SME Notification Digital Public Service |

| |

|

Business Digital Public Services Catalogue |

VAT4SME Quarterly Report Digital Public Service |

| |

|

Business Digital Public Services Catalogue |

National eIdentification |

| |

|

VAT4SME Exemption and Cessation Digital Public Service |

Treatament of the VAT4SME`s exemptions and cessations |

| |

|

VAT4SME Notification Digital Public Service |

Management of the VAT4SME schema's notifications |

| |

|

VAT4SME Quarterly Report Digital Public Service |

Management of the VAT4SME schema's quarterly reports |

| |

|

National eIdentification |

<<eira:Digital Business Capability>> Electronic identification |

| |

|

Application Digital Public Services |

VAT4SME Notifications Digital Solution Service |

| |

|

Application Digital Public Services |

VAT4SME Exemption and Cessation Digital Solution Service |

| |

|

Application Digital Public Services |

VAT4SME Quarterly Reports Digital Solution Service |

| |

|

Application Digital Public Services |

Authentication Service |

| |

|

VAT4SME Notifications Digital Solution Service |

VAT4SME Notification Digital Public Service |

| |

|

VAT4SME Exemption and Cessation Digital Solution Service |

VAT4SME Exemption and Cessation Digital Public Service |

| |

|

VAT4SME Quarterly Reports Digital Solution Service |

VAT4SME Quarterly Report Digital Public Service |

| |

|

Authentication Service |

National eIdentification |

| |

|

Technology Digital Public Services |

eIDAS-Node |

| |

|

Technology Digital Public Services |

Container-Managed Microservices |

| |

|

Technology Digital Public Services |

VAT4SME HTML Human Interface |

| |

|

Technology Digital Public Services |

Shared Infrastructure Services |

| |

|

Technology Digital Public Services |

Enterprise Service Bus |

| |

|

Technology Digital Public Services |

<<CCN/CSI>> CCN2 |

| |

|

Technology Digital Public Services |

<<eira:OutsourcingFacility>> Cloud Provider Facility |

| |

|

Technology Digital Public Services |

<<eira:On-premisesFacility>> On-Premise Facility |

| |

|

Technology Digital Public Services |

VAT4SME Exemption Service |

| |

|

Technology Digital Public Services |

VAT4SME Cessation Service |

| |

|

Technology Digital Public Services |

VAT4SME Notification Service |

| |

|

Technology Digital Public Services |

VAT4SME Quarterly Report Service |

| |

|

eIDAS-Node |

Authentication Service |

| |

|

Container-Managed Microservices |

MCC.2911080 - Respect the legal base |

| |

|

Container-Managed Microservices |

VAT4SME Exemption Service |

| |

|

Container-Managed Microservices |

VAT4SME Cessation Service |

| |

|

Container-Managed Microservices |

VAT4SME Notification Service |

| |

|

Container-Managed Microservices |

VAT4SME Quarterly Report Service |

| |

|

VAT4SME HTML Human Interface |

MCC.2911160 - User friendly system |

| |

|

Shared Infrastructure Services |

MCC.2911120 - Support security and user authentication for Electronic interface |

| |

|

Shared Infrastructure Services |

MCC.2911000 - Compliance with the data protection |

| |

|

Shared Infrastructure Services |

MCC.2911020 - Message exchange logging |

| |

|

Shared Infrastructure Services |

MCC.2911040 - MS of establishment must store the data for at least 5 years |

| |

|

Shared Infrastructure Services |

MCC.2910980 - Ability to store structured data |

| |

|

Enterprise Service Bus |

MCC.2911020 - Message exchange logging |

| |

|

<<CCN/CSI>> CCN2 |

MCC.2911180 - Using secure network for communication with other MSs |

| |

|

<<eira:OutsourcingFacility>> Cloud Provider Facility |

MCC.2911080 - Respect the legal base |

| |

|

<<eira:OutsourcingFacility>> Cloud Provider Facility |

MCC.2911140 - System availability |

| |

|

<<eira:On-premisesFacility>> On-Premise Facility |

MCC.2911080 - Respect the legal base |

| |

|

<<eira:On-premisesFacility>> On-Premise Facility |

MCC.2911140 - System availability |

| |

|

VAT4SME Exemption Service |

VAT4SME Exemption and Cessation Digital Solution Service |

| |

|

VAT4SME Cessation Service |

VAT4SME Exemption and Cessation Digital Solution Service |

| |

|

VAT4SME Notification Service |

VAT4SME Notifications Digital Solution Service |

| |

|

VAT4SME Quarterly Report Service |

VAT4SME Quarterly Reports Digital Solution Service |