NARRATIVE:

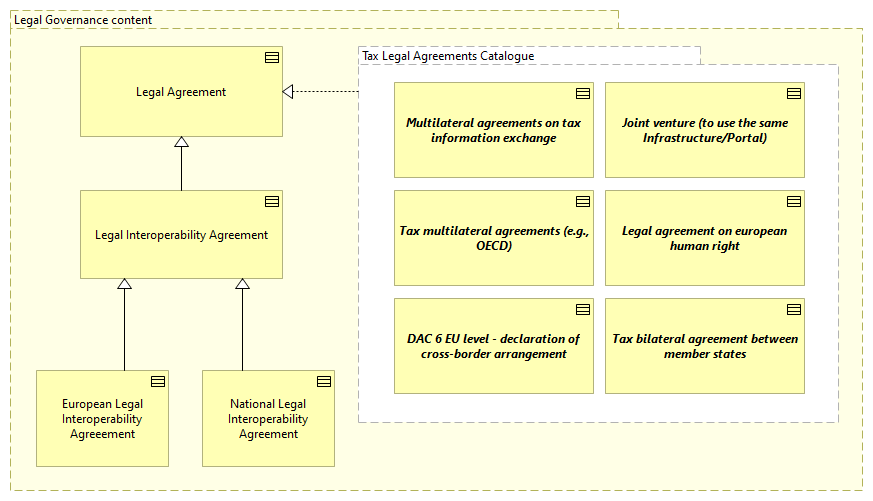

The LV-Legal Agreements view extends Legal view and provides a comprehensive framework for leveraging the elements in the given JSON. The primary element in this view is the "Legal Governance content" which is a Grouping ABB. This grouping refers to the rules, regulations, and institutions that govern and regulate the behavior of individuals, organizations, and governments. It involves the application of laws and policies to ensure accountability, fairness, and transparency in decision-making.

Within this grouping, there are several Contract ABBs, each with a specific purpose. The "Legal Interoperability Agreement" is a contract formalizing governance rules enabling collaboration between digital public services. The "Legal Agreement" is a contract enabling collaboration between digital public services across legal jurisdictions. The "European Legal Interoperability Agreement" is a contract formalizing governance rules enabling collaboration amongst the EU and EEA Member States digital public services. The "National Legal Interoperability Agreement" is a contract formalizing governance rules enabling collaboration amongst different levels of administrations in a State.

Another Grouping ABB within the "Legal Governance content" is the "Tax Legal Agreements Catalogue". This catalogue contains several Contract SBBs. These include "Tax bilateral agreement between member states", "DAC 6 EU level - declaration of cross-border arrangement", "Legal agreement on European human right", "Tax multilateral agreements (e.g., OECD)", "Joint venture (to use the same Infrastructure/Portal)", and "Multilateral agreements on tax information exchange".

The relationships between these elements are defined by their placement within the grouping and their type. The Contract ABBs are part of the "Legal Governance content" grouping and are related to each other in that they all pertain to legal agreements enabling collaboration and governance in different contexts. The Contract SBBs within the "Tax Legal Agreements Catalogue" are related to each other as they all pertain to tax-related legal agreements.

The motivation for these elements and their relationships is to provide a comprehensive framework for understanding and managing the legal agreements that govern and enable collaboration between digital public services at various levels and in different contexts.