NARRATIVE:

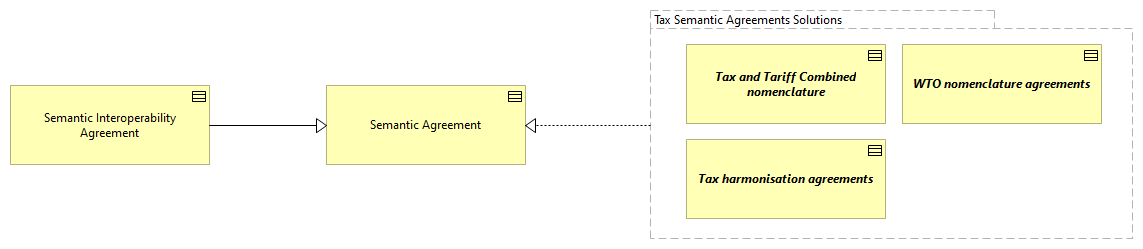

The SV-Tax Semantic Agreements Catalogue view extends Semantic view and provides a comprehensive framework for leveraging the semantic agreements and interoperability agreements in the context of tax and tariff regulations. This view is composed of three main elements: Semantic Agreement, Semantic Interoperability Agreement, and Tax Semantic Agreements Solutions.

The Semantic Agreement, classified as a Contract ABB, formalizes an agreement from a peer to the common ontology that is the result of a matching or mapping process used to resolve their semantic discrepancies. This process involves a linguistic base, internal and external structure comparison. The result of this matching combination is used to develop an agreement unit as a component of the agreement. The agreement operates under certain assumptions, such as using the same language to represent the schema/ontology, labels, and the meaning of a concept, and there is no individual at the common ontology.

The Semantic Interoperability Agreement, also a Contract ABB, formalizes governance rules enabling collaboration between digital public services with ontological value. This agreement is crucial for ensuring seamless interaction and data exchange between different digital public services.

The Tax Semantic Agreements Solutions is a Grouping ABB that encompasses three Contract SBBs: Tax and Tariff Combined Nomenclature, WTO Nomenclature Agreements, and Tax Harmonisation Agreements. These contracts represent specific semantic agreements related to tax and tariff regulations. The Tax and Tariff Combined Nomenclature Contract outlines the combined nomenclature for tax and tariff. The WTO Nomenclature Agreements Contract details the agreements on nomenclature as per the World Trade Organization. The Tax Harmonisation Agreements Contract formalizes agreements for harmonizing tax regulations.

The relationships between these elements are primarily hierarchical, with the Semantic Agreement and Semantic Interoperability Agreement being overarching contracts that govern the specific agreements within the Tax Semantic Agreements Solutions grouping. The motivation behind this structure is to provide a comprehensive and structured approach to managing semantic agreements in the context of tax and tariff regulations, thereby facilitating semantic interoperability and collaboration between digital public services.

| Semantic Agreement | |

| Semantic Interoperability Agreement | |

| Tax Semantic Agreements Solutions | |

| Tax and Tariff Combined nomenclature | |

| WTO nomenclature agreements | |

| Tax harmonisation agreements |