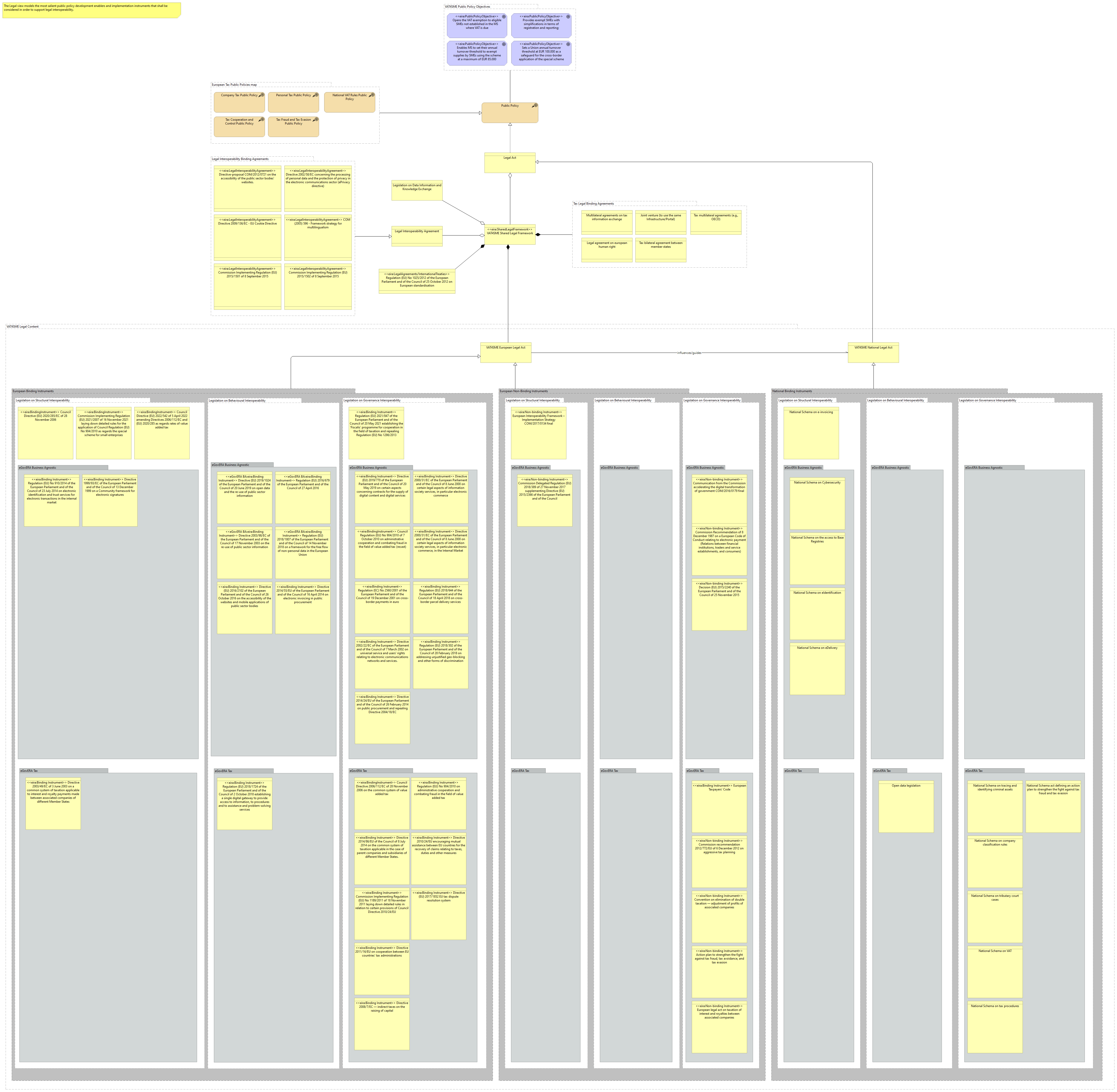

The Legal view models the most salient public policy development enablers and implementation instruments that shall be considered in order to support legal interoperability.

Narrative: A [Public Policy] is the outcome of a specific [Public Policy Cycle] that aims at addressing the needs of a group of stakeholders. The policy is formulated and implemented with the help of [Public Policy Formulation and Implementation Instruments] such as [Legal Requirements or Constraints] in the form of either [Binding Instruments] or [Non-Binding Instruments], or [Operational Enablers], such as [Financial Resources] or [Implementing Guidelines]. The [Operational Enablers] are influenced by [Public Policy Implementation Mandates] and/or [Public Policy Implementation Approaches]. The [Public Policy Formulation and Implementation Instruments] are included in a [Legislation Catalogue].

These different Architecture Building Blocks define the [Legal content] and each of these Architecture Building Blocks can have any [Interoperability Specification] associated, of which the [Legal Interoperability Specification] is a specialisation.

| dct:title | Legal view |