| |

|

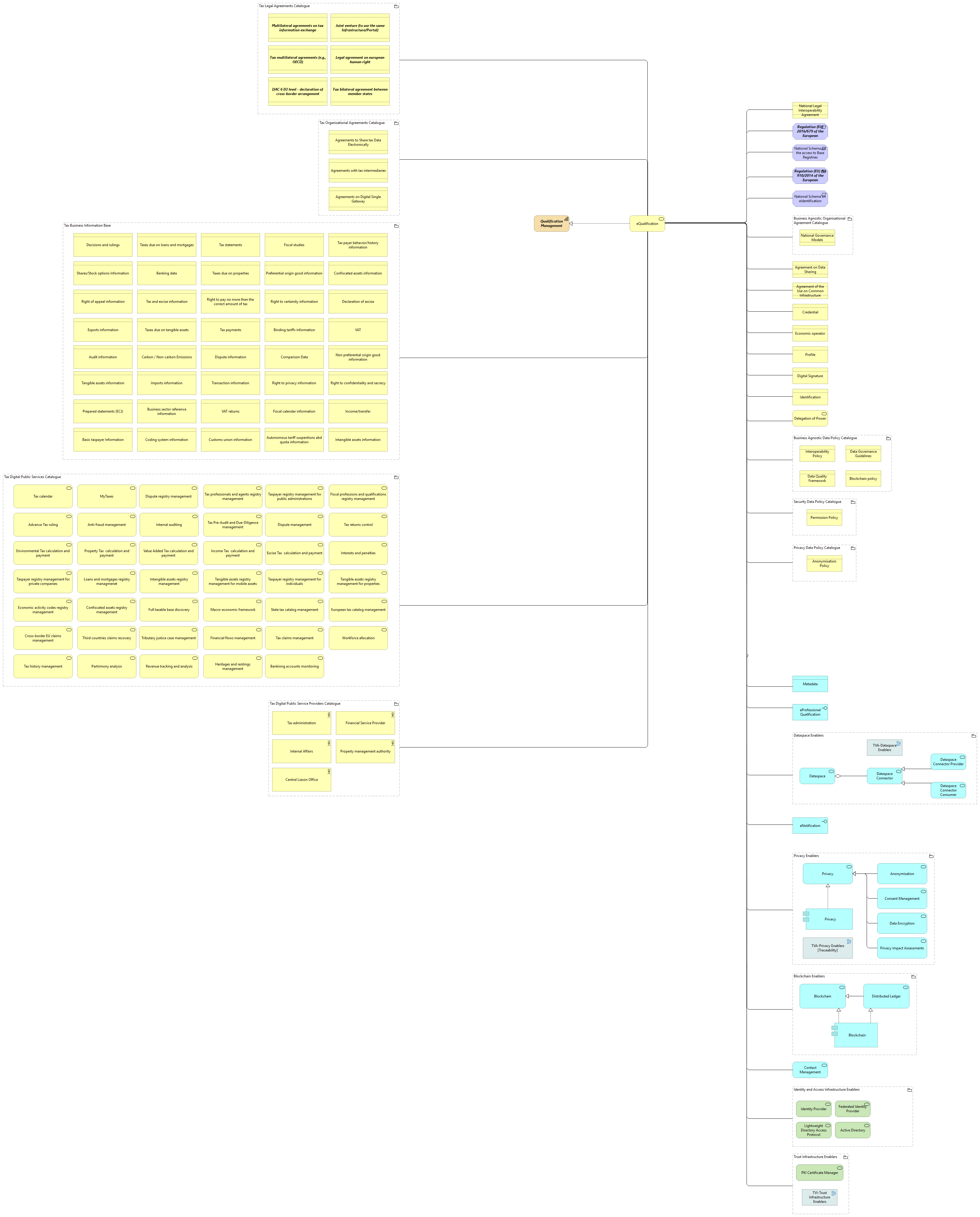

eQualification |

Qualification Management |

| |

|

eQualification |

Business Agnostic Data Policy Catalogue |

| |

|

eQualification |

Security Data Policy Catalogue |

| |

|

eQualification |

Privacy Data Policy Catalogue |

| |

|

eQualification |

Metadata |

| |

|

eQualification |

eProfessional Qualification |

| |

|

eQualification |

Dataspace Enablers |

| |

|

eQualification |

eNotification |

| |

|

eQualification |

Identity and Access Infrastructure Enablers |

| |

|

eQualification |

Trust Infrastructure Enablers |

| |

|

National Legal Interoperability Agreement |

eQualification |

| |

|

Regulation (EU) 2016/679 of the European Parliament and of the Council of 27 April 2016 |

eQualification |

| |

|

National Schema on the access to Base Registries |

eQualification |

| |

|

Regulation (EU) No 910/2014 of the European Parliament and of the Council of 23 July 2014 |

eQualification |

| |

|

National Schema on eIdentification |

eQualification |

| |

|

Business Agnostic Organisational Agreement Catalogue |

National Governance Models |

| |

|

Business Agnostic Organisational Agreement Catalogue |

eQualification |

| |

|

Agreement on Data Sharing |

eQualification |

| |

|

Agreement of the Use on Common Infrastructure |

eQualification |

| |

|

Credential |

eQualification |

| |

|

Economic operator |

eQualification |

| |

|

Profile |

eQualification |

| |

|

Digital Signature |

eQualification |

| |

|

Identification |

eQualification |

| |

|

Delegation of Power |

eQualification |

| |

|

Business Agnostic Data Policy Catalogue |

Interoperability Policy |

| |

|

Business Agnostic Data Policy Catalogue |

Blockchain policy |

| |

|

Business Agnostic Data Policy Catalogue |

Data Quality Framework |

| |

|

Business Agnostic Data Policy Catalogue |

Data Governance Guidelines |

| |

|

Privacy Data Policy Catalogue |

Anonymisation Policy |

| |

|

Security Data Policy Catalogue |

Permission Policy |

| |

|

Dataspace Enablers |

Dataspace |

| |

|

Dataspace Enablers |

Dataspace Connector Consumer |

| |

|

Dataspace Enablers |

Dataspace Connector Provider |

| |

|

Dataspace Enablers |

Dataspace Connector |

| |

|

Dataspace |

Dataspace Connector |

| |

|

Dataspace Connector Consumer |

Dataspace Connector |

| |

|

Dataspace Connector Provider |

Dataspace Connector |

| |

|

Privacy Enablers |

Anonymisation |

| |

|

Privacy Enablers |

Data Encryption |

| |

|

Privacy Enablers |

Consent Management |

| |

|

Privacy Enablers |

Privacy Impact Assessments |

| |

|

Privacy Enablers |

eQualification |

| |

|

Privacy |

Privacy |

| |

|

Anonymisation |

Privacy |

| |

|

Consent Management |

Privacy |

| |

|

Data Encryption |

Privacy |

| |

|

Privacy Impact Assessments |

Privacy |

| |

|

Blockchain Enablers |

Blockchain |

| |

|

Blockchain Enablers |

Distributed Ledger |

| |

|

Blockchain Enablers |

Blockchain |

| |

|

Blockchain Enablers |

eQualification |

| |

|

Blockchain |

Distributed Ledger |

| |

|

Blockchain |

Blockchain |

| |

|

Distributed Ledger |

Blockchain |

| |

|

Contact Management |

eQualification |

| |

|

Trust Infrastructure Enablers |

PKI Certificate Manager |

| |

|

Identity and Access Infrastructure Enablers |

Lightweight Directory Access Protocol |

| |

|

Identity and Access Infrastructure Enablers |

Identity Provider |

| |

|

Identity and Access Infrastructure Enablers |

Federated Identity Provider |

| |

|

Identity and Access Infrastructure Enablers |

Active Directory |

| |

|

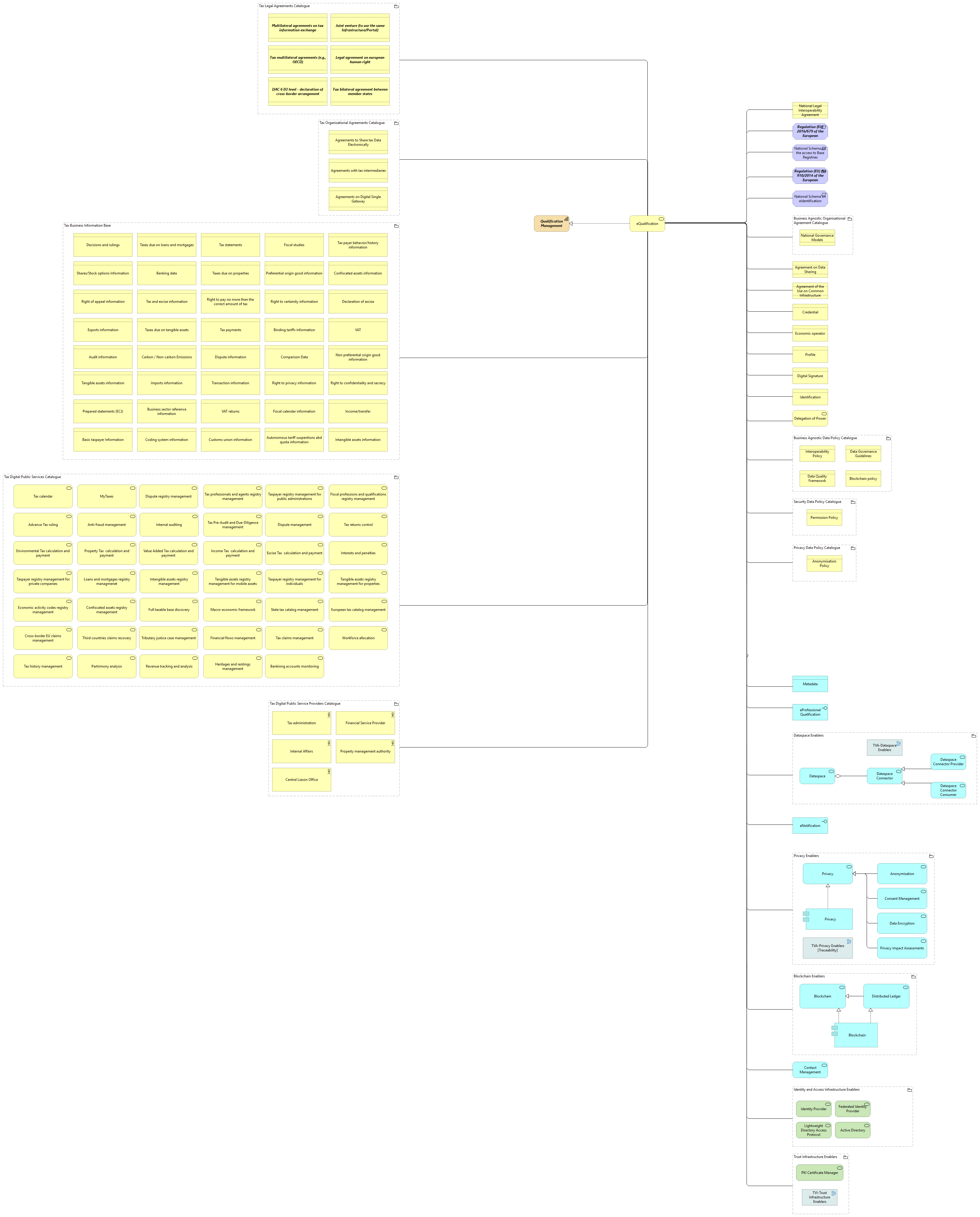

Tax Legal Agreements Catalogue |

DAC 6 EU level - declaration of cross-border arrangement |

| |

|

Tax Legal Agreements Catalogue |

Multilateral agreements on tax information exchange |

| |

|

Tax Legal Agreements Catalogue |

Tax bilateral agreement between member states |

| |

|

Tax Legal Agreements Catalogue |

Joint venture (to use the same Infrastructure/Portal) |

| |

|

Tax Legal Agreements Catalogue |

Legal agreement on european human right |

| |

|

Tax Legal Agreements Catalogue |

Tax multilateral agreements (e.g., OECD) |

| |

|

Tax Legal Agreements Catalogue |

eQualification |

| |

|

Tax Organisational Agreements Catalogue |

Agreements to Share tax Data Electronically |

| |

|

Tax Organisational Agreements Catalogue |

Agreements on Digital Single Gateway |

| |

|

Tax Organisational Agreements Catalogue |

Agreements with tax intermediaries |

| |

|

Tax Organisational Agreements Catalogue |

eQualification |

| |

|

Tax Business Information Base |

Declaration of excise |

| |

|

Tax Business Information Base |

Taxes due on tangible assets |

| |

|

Tax Business Information Base |

Right to privacy information |

| |

|

Tax Business Information Base |

Right to certainity information |

| |

|

Tax Business Information Base |

Shares/Stock options Information |

| |

|

Tax Business Information Base |

Right of appeal information |

| |

|

Tax Business Information Base |

Business sector reference information |

| |

|

Tax Business Information Base |

Exports information |

| |

|

Tax Business Information Base |

Right to confidentiality and secrecy |

| |

|

Tax Business Information Base |

Taxes due on loans and mortgages |

| |

|

Tax Business Information Base |

Taxes due on properties |

| |

|

Tax Business Information Base |

Tax and excise information |

| |

|

Tax Business Information Base |

Tax payer behavior/history information |

| |

|

Tax Business Information Base |

Confiscated assets information |

| |

|

Tax Business Information Base |

Right to pay no more than the correct amount of tax |

| |

|

Tax Business Information Base |

Dispute information |

| |

|

Tax Business Information Base |

Income/transfer |

| |

|

Tax Business Information Base |

Tax payments |

| |

|

Tax Business Information Base |

Banking data |

| |

|

Tax Business Information Base |

Autonomous tariff suspentions abd quota information |

| |

|

Tax Business Information Base |

Fiscal studies |

| |

|

Tax Business Information Base |

Comparison Data |

| |

|

Tax Business Information Base |

Imports information |

| |

|

Tax Business Information Base |

VAT |

| |

|

Tax Business Information Base |

Binding tariffs information |

| |

|

Tax Business Information Base |

Audit information |

| |

|

Tax Business Information Base |

Intangible assets information |

| |

|

Tax Business Information Base |

Coding system information |

| |

|

Tax Business Information Base |

Non preferential origin good information |

| |

|

Tax Business Information Base |

Tangible assets information |

| |

|

Tax Business Information Base |

Customs union information |

| |

|

Tax Business Information Base |

Preferential origin good information |

| |

|

Tax Business Information Base |

Tax statements |

| |

|

Tax Business Information Base |

Carbon / Non-carbon Emissions |

| |

|

Tax Business Information Base |

VAT returns |

| |

|

Tax Business Information Base |

Basic taxpayer Information |

| |

|

Tax Business Information Base |

Prepared statements (ECJ) |

| |

|

Tax Business Information Base |

Fiscal calendar information |

| |

|

Tax Business Information Base |

Decisions and rulings |

| |

|

Tax Business Information Base |

Transaction information |

| |

|

Tax Business Information Base |

eQualification |

| |

|

Tax Digital Public Services Catalogue |

Economic activity codes registry management |

| |

|

Tax Digital Public Services Catalogue |

Workforce allocation |

| |

|

Tax Digital Public Services Catalogue |

Fiscal professions and qualifications registry management |

| |

|

Tax Digital Public Services Catalogue |

Revenue tracking and analysis |

| |

|

Tax Digital Public Services Catalogue |

Environmental Tax calculation and payment |

| |

|

Tax Digital Public Services Catalogue |

State tax catalog management |

| |

|

Tax Digital Public Services Catalogue |

Full taxable base discovery |

| |

|

Tax Digital Public Services Catalogue |

Tributary justice case management |

| |

|

Tax Digital Public Services Catalogue |

Income Tax calculation and payment |

| |

|

Tax Digital Public Services Catalogue |

Financial flows management |

| |

|

Tax Digital Public Services Catalogue |

MyTaxes |

| |

|

Tax Digital Public Services Catalogue |

Tangible assets registry management for properties |

| |

|

Tax Digital Public Services Catalogue |

Dispute registry management |

| |

|

Tax Digital Public Services Catalogue |

Excise Tax calculation and payment |

| |

|

Tax Digital Public Services Catalogue |

Taxpayer registry management for private companies |

| |

|

Tax Digital Public Services Catalogue |

Bankinng accounts monitoring |

| |

|

Tax Digital Public Services Catalogue |

Taxpayer registry management for public administrations |

| |

|

Tax Digital Public Services Catalogue |

Advance Tax ruling |

| |

|

Tax Digital Public Services Catalogue |

Anti-fraud management |

| |

|

Tax Digital Public Services Catalogue |

Tax returns control |

| |

|

Tax Digital Public Services Catalogue |

Intangible assets registry management |

| |

|

Tax Digital Public Services Catalogue |

Tax history management |

| |

|

Tax Digital Public Services Catalogue |

Third countries claims recovery |

| |

|

Tax Digital Public Services Catalogue |

Interests and penalties |

| |

|

Tax Digital Public Services Catalogue |

European tax catalog management |

| |

|

Tax Digital Public Services Catalogue |

Partrimony analysis |

| |

|

Tax Digital Public Services Catalogue |

Tax professionals and agents registry management |

| |

|

Tax Digital Public Services Catalogue |

Tangible assets registry management for mobile assets |

| |

|

Tax Digital Public Services Catalogue |

Confiscated assets registry management |

| |

|

Tax Digital Public Services Catalogue |

Loans and mortgages registry managmenet |

| |

|

Tax Digital Public Services Catalogue |

Macro-economic framework |

| |

|

Tax Digital Public Services Catalogue |

Taxpayer registry management for individuals |

| |

|

Tax Digital Public Services Catalogue |

Tax Pre-Audit and Due-Diligence management |

| |

|

Tax Digital Public Services Catalogue |

Dispute management |

| |

|

Tax Digital Public Services Catalogue |

Heritages and rentings management |

| |

|

Tax Digital Public Services Catalogue |

Cross-border EU claims management |

| |

|

Tax Digital Public Services Catalogue |

Internal auditing |

| |

|

Tax Digital Public Services Catalogue |

Property Tax calculation and payment |

| |

|

Tax Digital Public Services Catalogue |

Value Added Tax calculation and payment |

| |

|

Tax Digital Public Services Catalogue |

Tax calendar |

| |

|

Tax Digital Public Services Catalogue |

Tax claims management |

| |

|

Tax Digital Public Services Catalogue |

eQualification |

| |

|

Tax Digital Public Service Providers Catalogue |

Property management authority |

| |

|

Tax Digital Public Service Providers Catalogue |

Tax administration |

| |

|

Tax Digital Public Service Providers Catalogue |

Financial Service Provider |

| |

|

Tax Digital Public Service Providers Catalogue |

Internal Affairs |

| |

|

Tax Digital Public Service Providers Catalogue |

Central Liason Office |

| |

|

Tax Digital Public Service Providers Catalogue |

eQualification |